While the definition of sales cycle can differ depending on whom you’re talking too, essentially it refers to the process that a company uses to obtain a new customer. It includes all activities associated with closing a sale. These steps and processes in a sales cycle can differ from one company to the next, depending on exact steps a company takes when closing a sale.

Sales cycles can differ a lot, especially when it comes to specific industries. This is because the definition that does exist has different variations. For example, some people define it as when a qualified prospect is brought in and closed. Others suggest it’s the time it takes from starting from nothing to closing a deal.

Regardless of what definition you use, knowing how your sales cycle works is key to fully optimizing your sales process. You can’t improve your sales process if you’re not tracking it, so step one is tracking this cycle.

Why Is The Sales Cycle Important?

Tracking your sales cycle will allow you to collect business insights into the efficiency of your sales operations. Why is this important? Well, the length of this process can be audited, analyzed, and compared to the standard length across your specific industry. If your cycle is shorter than industry averages, this could reflect that your company sales department is more effective than competitors.

Generally speaking, having a fast sales cycle is a good thing. The longer the cycle, the greater the opportunity for sales to fall through. If there are strategies that can be implemented to shorten this cycle, it’s often recommended.

Sales cycles can also vary by campaign, so it’s not uncommon to have multiple sales cycle within a company.

What Are The Stages Of Sales Cycles?

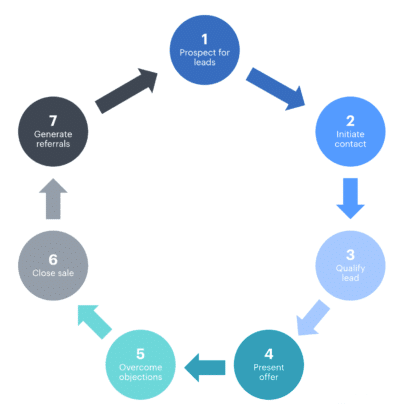

It doesn’t matter what you’re selling – every sales cycle contains stages. These sales cycle stages can vary depending on the industry your company serves, so keep that in mind as we reveal each stage.

It doesn’t matter what you’re selling – every sales cycle contains stages. These sales cycle stages can vary depending on the industry your company serves, so keep that in mind as we reveal each stage.

- Prospecting And Lead Generation

- Initial Contact, Building A Relationship

- Identifying Prospect Needs And Qualifying

- Presenting An Offer

- Handling Objections

- Closing The Sale

- Getting Referrals

While your cycle can differ, the majority of companies are going to have a sales cycle with some of these same core pillars in place.

(1) Prospecting And Lead Generation

One of the most important steps in every sales cycles is a company’s ability to build high quality leads and prospects. With advancements in technology, building an automated lead generation sequence is easy. Prospecting is easier, too, as many potential customers are engaging with brands online, especially through social media.

(2) Initial Contact, Building A Relationship

Successful companies give their audience multiple ways to engage with their brand, leading to more opportunities to engage prospects and build an authentic relationship with them. Depending on the industry you serve, this stage can be hours, days, weeks or longer.

(3) Identifying Prospect Needs And Qualifying

At this point in the sales cycle, you have one goal: identify your prospects needs. During the same time, you want to begin qualifying your prospects, too. Usually at this point, the prospect has scheduled an appointment or strategy session.

(4) Presenting An Offer

Once a prospect has been qualified, you can then provide a solution to solve that problem. This is where you present your offer to the prospect. Some companies may only have one offer, while other companies may present multiple offers during this stage of the sales cycle.

(5) Handling Objections

If you’ve been on a closing call or strategy session, you know the prospect will likely have objections they need to overcome to become a customer.

(6) Closing The Sale

Once you’ve qualified the prospect, handled objections and presented an offer, it’s time to close the sale.

(7) Getting Referrals

Referrals are important to all companies, so make sure you ask for referrals after you’ve closed the sale.

Tracking Your Sales Cycle

The data you collect during the sales cycle is going to allow you to optimize all areas of your sales process, but only when you’re tracking everything.

Here are a few important KPIs to consider.

- Which lead magnets are generating the most qualified leads?

- What’s the most common objection prospects have about our service?

- How long does it take on average to close a new client?

- What are the most common questions we’re being asked about our offer?

- Which age group is responsible for the most completed sales?

These are just a few of the insights you can gain by tracking your sales cycle, providing you with the data you’re going to need to improve your sales cycle.

For example, if our company averages 60 days from the first contact to a sale, I want to know how we can do it in 45 days.

If I have 3 lead magnets and one is converting leads at 50 percent, I want to know why that’s happening so I can improve my other two.

As long as you’re tracking your sales cycle, it gives you the opportunity to optimize your cycle and make it better.

POS Reporting

If you want to take your sales reporting to the next level, Accelerated Analytics can help. Sales are the lifeblood of your business and sales data can get complex. Your sales data doesn’t have to be complicated. Your POS data can give you valuable insights to your company’s sales performance.