Retailers are constantly talking about the future, but what technologies are going to take them there?

When we think about innovations like chatbots, personalized product recommendations, dynamic pricing and programmatic display, there’s one common denominator. All of these are great examples of how artificial intelligence can be a game-changer for a multichannel retailer.

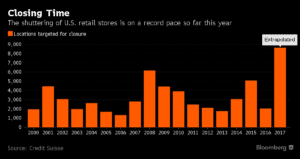

Over the next three to five years, AI will play a significant role in the multichannel retail market. It will help differentiate the winning organizations, as well as determine which ones close their physical and digital doors.

It’s easy to think of AI as a buzzword, but based on a study of more than 13,000 consumers, brands with the most sophisticated, personalized customer experiences have higher satisfaction and Net Promoter Scores, as well as higher retention. Using AI, machine learning and technology to highlight what makes the brand and their buyers unique is what sets apart retailers like Sephora and Nordstrom.

Global retail sector technology spending is expected to grow 3.6% year-over-year to reach almost $203.6 billion this year. Similar spending is projected for the next two years as well, with the fastest-growing category being software. As consumer expectations for highly-connected experiences continue to increase, it’s critical for retailers to become versed in how to buy and apply AI — and quickly.

This post is based on an article written by Jason Grunberg for SailThru.