When it comes to important calculations for your business, ending inventory formula is one that’s super important. Ending inventory formula is used to calculate the value of goods available for sale at the end of the accounting period. When it comes to inventory management and utilizing your POS data, these formulas can play an important role in the decisions you make for your company.

Every company wants inventory control. Ending inventory is usually recorded on a balance sheet at the lower cost or its market value. Also referred to as Closing Stock, ending inventory usually have 3 types of inventory.

- Finished Goods

- Raw Materials

- Work In Progress (WIP)

Now, there’s 3 methods used to calculate these. Let’s take a closer look at each.

First In First Out Method (FIFO)

If you’re using the First In First Out Inventory Method, it means the first item purchases is going to be the first item sold, which means the cost of purchase for the first item is the cost of the first item sold which would result in closing inventory reported by the company. That amount would be placed in the balance sheet showing the approximate current cost as its value, which would be based on the most recent purchase. If there’s inflation, ending inventory is going to be higher using this method compared to the other methods.

Last In First Out Method (LIFO)

If you’re using the Last In First Out Inventory Method, the last item purchases is going to be the cost of the first item sold, which would result in closing inventory reported by the company. That amount is placed in the balance sheet and would show the cost of the earliest items purchased. If there’s inflation, ending inventory is often less than the current cost. In this case, when prices are rising, ending inventory will be lower.

Weighted Average Cost Method

If you’re using the Weighted Average Cost Method, the average cost per unit is computed by dividing the total cost of goods available for sale. The ending inventory equation is value by multiplying the average cost per unit by the number of units available at the end of the reporting period.

Ending inventory formula is the value of goods or products that remain unsold or remains at the end of the reporting period (either the financial period or the accounting period). It is always based on the market value or cost of the goods, which ever is lower. It makes sense to keep track of the ending inventory as the same is carried forward to the next reporting period and becomes the beginning inventory. If there’s inaccuracies measured in the ending inventory, it will result in financial implication in the new reporting period also.

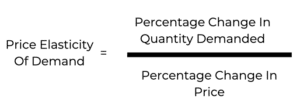

The valuation of ending inventory has a widespread impact on the various line items on the Income Statement, mainly Cost Of Goods Sold (COGS), New Profit and Gross Profit. On the Balance Sheet, it impacts Current Assets, Total Assets, Working Capital, which will impact several important financial ratios, such as Current Ratio, Quick Ratio, Inventory Turnover Ratio, Gross Profit Ratio and Net Profit Ratio.

Estimating Ending Inventory Formula

When it comes to estimating ending inventory formula, there’s two different methods you can use. It’s important to note that this is not meant to be completely accurate. After all, you’re using historical data to make an estimate. However, in most scenarios, it should be a close reasonable estimate.

With that said, here’s the 2 formulas.

- Gross Profit Method

- Retail Inventory Method

Gross Profit Method

- Add the Cost Of Beginning Inventory and Cost Of Purchases together during the proper period. This will give you your Cost Of Goods Available For Sale.

- Multiply by 1 your Expected Gross Profit by Sales during the proper period to get your Estimated Cost Of Goods Sold.

- Subtract the Estimated Cost Of Goods Sold (Step 2) from the Cost Of Goods Available For Sale (Step 1).

Note: The Gross Profit Method relies on historical gross margin, which may not be the margin experienced in your most recent accounting period. You may also have inventory losses in the same period. Both can influence your estimate.

Retail Inventory Method

The next method to use is the Retail Inventory Method. This is commonly used by retailers to calculate their ending inventory. This method used the proportion of the retail price cost in prior periods for the formula’s foundation.

- Calculate your Cost-To-Retail Percentage, the formula is (Cost / Retail Price).

- Next, calculate your Cost Of Goods Available For Sale, the formula is (Cost of Beginning Inventory + Cost of Purchases).

- Then calculate the Cost Of Sales during the period, the formula is (Sales x Cost-To-Retail Percentage).

- Calculate Ending Inventory, for which the formula is (Cost of Goods Available For Sale – Cost of Sales during the period).

It’s important to note that this method only works if you consistently mark up your products by the same percentage. You also need to have continued to use the same markup percentage in the current period. Discounts and Out Of Stock can have an impact on your calculation.

Remember, the last 2 methods are for estimating ending inventory only, you can’t beat using a physical count or cycle counting program, even using the methods we first shared above.