Reliance Worldwide Corporation was presented with the Spark Award at the Suppliers Reception held on Sunday, January 7, 2018 at The New American Home® in Orlando, Florida, prior to the opening of the International Builders Show®. RWC recently joined Accelerated Analytics family of customers in the DIY, home and hardware retail segment, to process their retail POS sales and inventory data and provide actionable reports for their sales, planning and executive teams.

Reliance Worldwide Corporation was presented with the Spark Award at the Suppliers Reception held on Sunday, January 7, 2018 at The New American Home® in Orlando, Florida, prior to the opening of the International Builders Show®. RWC recently joined Accelerated Analytics family of customers in the DIY, home and hardware retail segment, to process their retail POS sales and inventory data and provide actionable reports for their sales, planning and executive teams.

Author: Helen Thomas

Lowe’s CEO Announces Retirement

Lowe’s announced today that CEO, Robert Niblock, will be retiring after 25 years with the home improvement retailer. Mr. Niblock will retain his position as chairman, president and CEO until the board selects his replacement. He became CEO in 2005 and was in charge of the $2.4 billion acquisition of Canadian retailer Rona, Inc.

Lowe’s announced today that CEO, Robert Niblock, will be retiring after 25 years with the home improvement retailer. Mr. Niblock will retain his position as chairman, president and CEO until the board selects his replacement. He became CEO in 2005 and was in charge of the $2.4 billion acquisition of Canadian retailer Rona, Inc.

“As we transition to the next chapter, I have great confidence in the strength of our team and the opportunity ahead for Lowe’s,” Niblock said in a statement. “I look forward to assisting the board with its search, and I am committed to supporting a seamless transition for all of our stakeholders.”

David Batchelder, who is a new Lowe’s board member and former director at rival Home Depot, will be chairing the committee to find Niblock’s replacement. Lowe’s executives are looking for ways to increase revenue and improve customer results, and did recently close in on Home Depot with same store sales growth.

February Home Sales Prove Housing Market Has Not Peaked

The National Association of Realtors announced Wednesday that previously owned home sales in February grew 3% over the previous month. Sales versus February of last year were up 1.1%. This comes after a two month drop in sales in January and December. The change in February eases concerns that the housing market had peaked. However, the market appears to be shifting from new home sales to previously owned home sales. Demand for previously owned homes is rising due to increased mortgage rates and higher home prices, which happen when other parts of the economy improve. The national median home price rose to $241,700, and the average interest rate for a 30-year, fixed-rate mortgage are now at 4.4%. Previously owned homes are seeing the higher demand and a smaller availability, with those current homeowners wary of selling and getting into a new home with higher rates. Builders are ramping up construction but are struggling. Total US housing starts in February declined 7%.

The National Association of Realtors announced Wednesday that previously owned home sales in February grew 3% over the previous month. Sales versus February of last year were up 1.1%. This comes after a two month drop in sales in January and December. The change in February eases concerns that the housing market had peaked. However, the market appears to be shifting from new home sales to previously owned home sales. Demand for previously owned homes is rising due to increased mortgage rates and higher home prices, which happen when other parts of the economy improve. The national median home price rose to $241,700, and the average interest rate for a 30-year, fixed-rate mortgage are now at 4.4%. Previously owned homes are seeing the higher demand and a smaller availability, with those current homeowners wary of selling and getting into a new home with higher rates. Builders are ramping up construction but are struggling. Total US housing starts in February declined 7%.

Sources: The Wall Street Journal

Retail and Construction Jobs Increase in February

February was a huge month for retail employment, seeing an increase of over 46,000 new jobs over January. This was four times greater than the amount of jobs added in January over December. General merchandise stores were up by 17,700 jobs. Clothing and accessory stores were up 14,900, and building materials stores added 10,300 jobs.

February was a huge month for retail employment, seeing an increase of over 46,000 new jobs over January. This was four times greater than the amount of jobs added in January over December. General merchandise stores were up by 17,700 jobs. Clothing and accessory stores were up 14,900, and building materials stores added 10,300 jobs.

“This substantial gain in retail jobs is a significant positive sign regarding the health and viability of the industry,” said Jack Kleinhenz, NRF chief economist. “It is stronger than expected and there were broad gains across most retail sectors.”

With the improvement in the economy and job growth, construction hiring is also expanding. The segment added 61,000 jobs in February, which was the biggest gain in over 11 years. With the housing recession that ended in 2009, there were 500,00 jobs cut, so growth now is still catching up to former levels, which equates to more room for growth in jobs for the sector.

Sources: The Wall Street Journal, Chain Store Age

Accelerated Analytics Customers in the News

L’Oreal, who utilizes Accelerated Analytics for its retailer point of sale data collection and harmonization for the majority of its US Luxe division retailers, revealed its 2017 results this week. Chairman and CEO, Jean-Paul Agon, spoke at a financial analysts’ meeting with specific results. In the final quarter of the fiscal 2017 year, sales were up 4.1% and 5.5% in same store comps versus 2016. Their full 2017 results were up 0.7% and 4.8% in comps. While he acknowledged, “The beauty market grew at a healthy pace,” the “making of it turned out to be somewhat different from our expectations.” The luxury color cosmetics and skin care both accelerated the sales growth. Mass-market beauty grew less than in 2016. China and travel retail were the strongest sectors and North America grew, yet not as strong as 2016.

Genesco, a Nashville-based specialty retailer and footwear, head wear, sports apparel and accessories vendor, uses Accelerated Analytics for POS reporting for many of its key US retailer accounts. The company announced this week its intention to focus heavier on its footwear business, and is exploring the sale of its Lids Sports Group division. They stated its footwear business is “the optimal platform to deliver enhanced shareholder value over the long term.” They continued to state that its sales “would generate capital that the company can deploy productively to further enhance shareholder value.” A committee and capital firm have been engaged to explore this possibility that is currently in the infancy stages.

Sources: Chainstoreage.com, WWD.com

2018 Looks Like a Promising Year for Retail

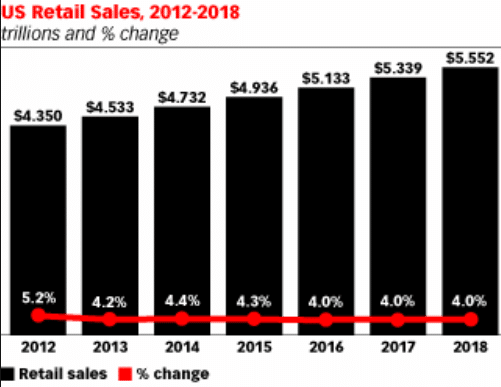

The week of February 4 through February 10 kicked off the new 4-5-4 retail calendar year. 2017 ended with a 53rd week, which occurs every 4 years. Retailers reported $3.53 trillion in sales for 2017, up 3.9% over 2016. Retail industry experts are expecting this new 2018 retail year to do well.

The week of February 4 through February 10 kicked off the new 4-5-4 retail calendar year. 2017 ended with a 53rd week, which occurs every 4 years. Retailers reported $3.53 trillion in sales for 2017, up 3.9% over 2016. Retail industry experts are expecting this new 2018 retail year to do well.

The NRF (National Retail Federation) is predicting 2018 sales to grow approximately 4% over 2017, including a record 10-12% increase in online sales, with mall kiosks, pop ups, catalogs and vending machines. NRF President and CEO, Matthew Shay, announced in a press call, “We think these confirm once again that the retail industry, while continuing to transform, is alive and well.” Increases are being attributed to the tax cuts to the corporate tax rates, the decrease in unemployment and increases in take home pay for consumers.

While there were 7,000 major store closings last year, there were also 3,200 new store openings. Retailers are adapting to consumer changing buying trends but are feeling optimistic and “very positive”, says Shay.

Retail trends that look to shape retail in 2018 include urbanization of stores as more people move to cities. The World Bank estimates more than 1 million people per week moving to cities, with greater access to stores. Consumers are also getting better at managing the large amount of online data being shown to them, allowing for retailers to share product information virtually while paring down stores for a showroom experience.

Effective use of Big Data is key for a retailer’s success. The data can be used to tell them customer loyalty, customer preferences, regional and national nuances, and inventory tracking as they redefine their brick and mortar spaces and expand their online presence and success at a seamless multichannel strategy to keep customers happy, as they can complete a transaction anywhere.

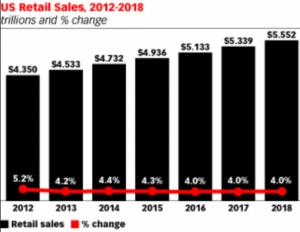

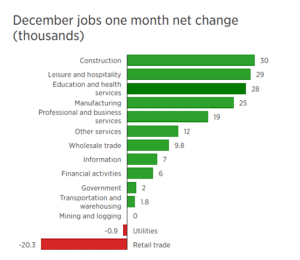

Retail Industry Job Changes

The retail industry suffered job losses in 2017, ending December with a 20% decrease in jobs in the retail trade. There was a lot of job expansion in other industries, with huge growth in construction and hospitality, with retail and utilities being the only to drop. The trend of decreasing retail jobs is being attributed to the ongoing shift to e-commerce sales. Retail posted a net loss of 70,000 jobs in the past 12 months. There was good news this past week for retail in the Home Improvement and Hardware retail sector, as both Home Depot and Lowe’s posted the news they would be providing their full-time employees with up to $1000 bonuses, a result of the tax breaks recently approved.

The retail industry suffered job losses in 2017, ending December with a 20% decrease in jobs in the retail trade. There was a lot of job expansion in other industries, with huge growth in construction and hospitality, with retail and utilities being the only to drop. The trend of decreasing retail jobs is being attributed to the ongoing shift to e-commerce sales. Retail posted a net loss of 70,000 jobs in the past 12 months. There was good news this past week for retail in the Home Improvement and Hardware retail sector, as both Home Depot and Lowe’s posted the news they would be providing their full-time employees with up to $1000 bonuses, a result of the tax breaks recently approved.

Lowe’s is the Place to Work this Spring

Lowe’s is gearing up for Spring, adding 53,000 full time, part time and seasonal employees to its current 250,000.  Lowe’s offers its employees a lot of benefits, even to those who are seasonal or part time in most cases. They provide a 10% employee discount, competitive wages, flex hours and the ability to see their schedule 17 days in advance in order to swap shifts if necessary. Part time and full time employees can also take advantage of their health and wellness benefits, incentive program, 401(k), stock purchase plan, and tuition reimbursement. 200 current Lowe’s store managers started as seasonal employees. Lowe’s is also known as a company that gives back. Last year, all of Lowe’s 1700 stores in the US served their communities through a Lowe’s Heroes volunteer community project. They also gave $2.5 million to disaster relief after the two major hurricanes last year. The company also offers full time employees paid time off for community service. New job openings span across the US, with the largest markets and openings being Atlanta, Boston, Charlotte, Indianapolis, Los Angeles, Raleigh-Durham and New York.

Lowe’s offers its employees a lot of benefits, even to those who are seasonal or part time in most cases. They provide a 10% employee discount, competitive wages, flex hours and the ability to see their schedule 17 days in advance in order to swap shifts if necessary. Part time and full time employees can also take advantage of their health and wellness benefits, incentive program, 401(k), stock purchase plan, and tuition reimbursement. 200 current Lowe’s store managers started as seasonal employees. Lowe’s is also known as a company that gives back. Last year, all of Lowe’s 1700 stores in the US served their communities through a Lowe’s Heroes volunteer community project. They also gave $2.5 million to disaster relief after the two major hurricanes last year. The company also offers full time employees paid time off for community service. New job openings span across the US, with the largest markets and openings being Atlanta, Boston, Charlotte, Indianapolis, Los Angeles, Raleigh-Durham and New York.

Source: Lowes.com

NRF’s Big Show Talks With Home Depot and Other Retailers About Millennial and Gen Z Engagement

Senior VP of Store Operations at The Home Depot, Marc Brown, joined a panel at the NRF’s Big Show this month to talk about the importance of engaging younger shoppers and the different methods they are undertaking to make that customer connection. The younger generation is particularly devoted to shopping at retailers who try to make a difference. Mr. Brown spoke about Home Depot’s long-term charity work, such as with Habitat for Humanity, helping veterans find housing and disaster relief efforts. “There’s a period of time where the business part doesn’t matter because you’ve got to get things back to normal for that community, “ he said.

Senior VP of Store Operations at The Home Depot, Marc Brown, joined a panel at the NRF’s Big Show this month to talk about the importance of engaging younger shoppers and the different methods they are undertaking to make that customer connection. The younger generation is particularly devoted to shopping at retailers who try to make a difference. Mr. Brown spoke about Home Depot’s long-term charity work, such as with Habitat for Humanity, helping veterans find housing and disaster relief efforts. “There’s a period of time where the business part doesn’t matter because you’ve got to get things back to normal for that community, “ he said.

With Millenials’ and Gen Zers’ heavy use of social media, this outlet is increasingly a growing part of the brand-consumer relationship. 55% of Gen Zers choose brands specifically because they are socially responsible or eco-friendly and 66% of consumers want retailers to take a stand on important political issues.

To read more on the buying behaviors of this younger generation of shoppers, check out our infographic, What Retail Needs to Know About Generation Z. Accelerated Analytics partners annually with many of its retail vendor customers to volunteer at a Habitat for Humanity build site in our home town of Sarasota, FL. You can read more about these efforts and the brands who partner with us, here. Our customer, Kidde, also partnered with The Home Depot last Fall to distribute smoke alarms across the country.

Source: RetailDive.com

Home Depot and Lowe’s Stock Growth in Last 6 Months

With improved employment levels and the housing market booming above 2006 levels, home improvement retail stocks have continued to grow. The Home Depot has outpaced the S&P 500 in the last 6 months, growing 39.3% versus the home improvement retail’s gain of 37.7% and S&P 500’s increase of 13.7%. The company attributes their success to maximizing square footage initiatives in current stores versus opening new ones, and focusing on the customer experience and buy online – deliver from store capabilities. Home Depot has been reporting strong numbers for the past 5 years, with record breaking year over year comps the past two quarters.

continued to grow. The Home Depot has outpaced the S&P 500 in the last 6 months, growing 39.3% versus the home improvement retail’s gain of 37.7% and S&P 500’s increase of 13.7%. The company attributes their success to maximizing square footage initiatives in current stores versus opening new ones, and focusing on the customer experience and buy online – deliver from store capabilities. Home Depot has been reporting strong numbers for the past 5 years, with record breaking year over year comps the past two quarters.

Back in October, The Home Depot stocks were trading at $163 and Lowe’s was only at $80, but since then Lowe’s is up 29% and Home Depot is up 21%. Home Depot has more physical stores in the US, with 2283 compared to 2144 at Lowe’s. Revenues through Q3 were much higher than Lowe’s but several other factors that can affect stock are looked at. As of Q3, gross margin for Home Depot was 34.1% and Lowe’s was 34.2%. Both CEOs are accredited for strategies that provide shareholder returns while minimizing risk. While The Home Depot’s revenues overall are higher, at $77B at Q3 compared to Lowe’s $53B, the average ticket is higher at Lowe’s, at $71.60 compared to Home Depot at $63.55.

Today Home Depot stock (HD) is reporting at $204.45 and Lowe’s (LOW) at $107.11.

Sources: Nasdaq.com, Seekingalpha.com