Retailers and vendors in today’s retail market face the unenviable challenge of reducing costs and maintaining margins, despite falling overall sales and slow-to-recover consumer demand. One of the areas in which retailers are pushing back onto vendors, is inventory management, which for vendors too often translates into retail partners that reduce overall inventories and require tightened delivery deadlines. Retailers view the supply chain as one of the key places in which costs can be reduced—or better yet, passed off onto someone else—as a means of keeping shareholders happy despite reduced POS sales. Wal-Mart continues to set the pace in this area, reducing its overall inventories across the board, reducing its brand assortments, adjusting its purchasing methods and imposing tough penalties on those that miss their Must Arrive By Date (MABD).

Thus, the impetus has fallen to vendors to manage their supply chains more efficiently, so that the cost-savings being realized by their retailers’ inventory adjustments might trickle down to them as well, instead of becoming a proverbial albatross. And while the “glass pipeline” may remain elusive, industry experts postulate that, “Visibility of supply chain costs have never been better.” Since, then, there remains continued pressure on everyone in the industry to reduce costs, there exists an opportunity now to address supply chain optimization unlike any time before.

As in all such processes, the first step in addressing this optimization is identifying the major challenges, which while not simple by any means, can be boiled down to three major focal points:

- Reduce supply chain costs

- Improving the responsiveness of the supply chain

- Managing demand volatility and Variability

From an IT perspective, there are things that can be done with the data already being generated or received by most companies (even small ones!) to address some significant portion of each of these.

Reducing Supply Chain costs

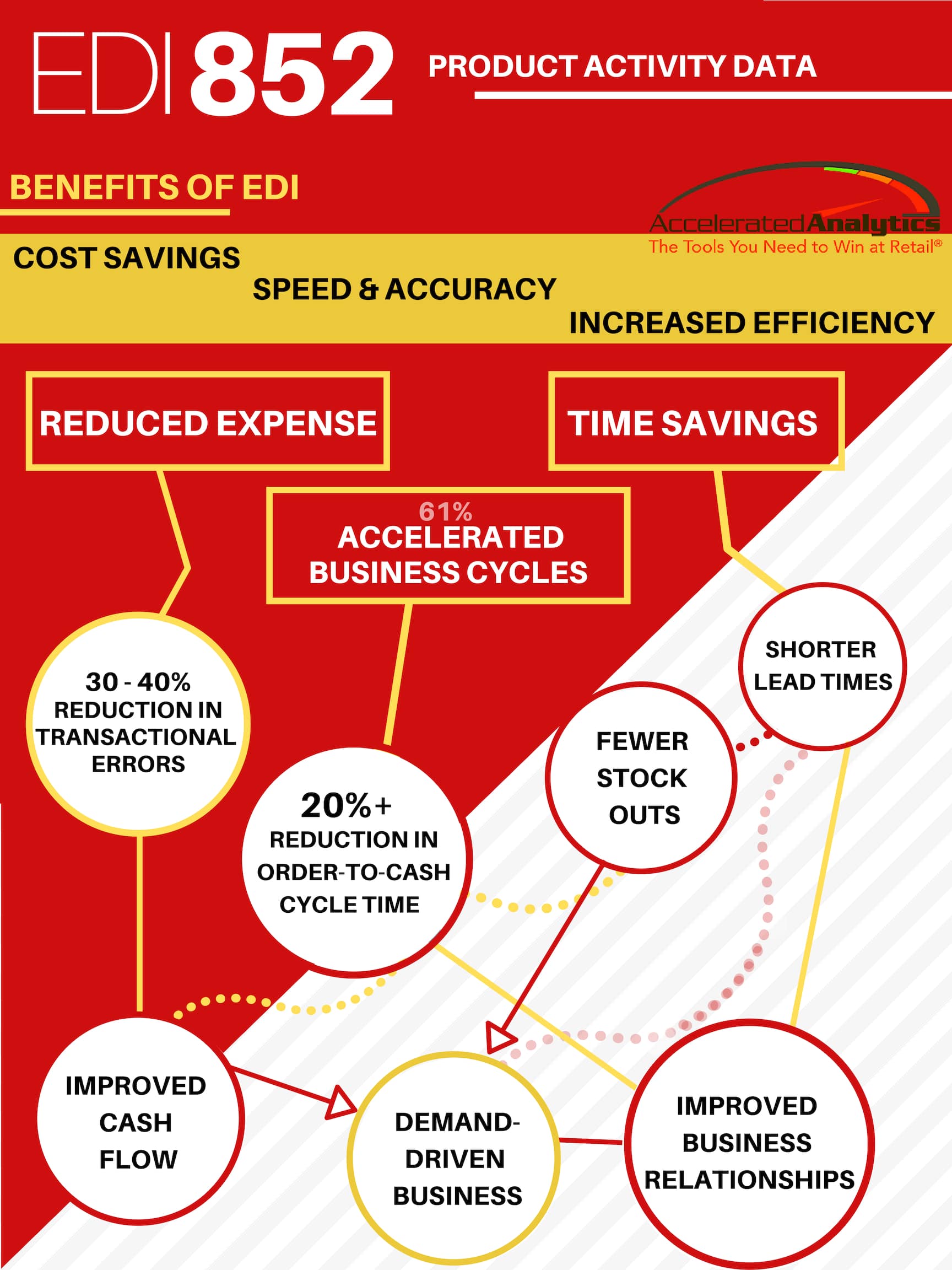

While the operating costs of a supply chain are often the easiest numbers to point to and the most difficult for IT to address, there are data sources that can be leveraged to reduce costs. For example, purchase orders, shipping data, and RTV (return to vendor) data is either generated internally or is received from retail partners (sometimes in a very straightforward EDI 812 document). Unfortunately for many companies, these data sources come from disparate business systems and are stored in multiple locations, so tracking a single PO from the time the order was received through the supply chain to its delivery at a store or in a DC is an arduous task requiring proficiency in Excel and fraught with the potential for human error. Further, when compounded by the volume of orders received that many vendors keep up with, the task of tracking becomes futile, since the actionable information it generates rarely is identified in time to take the given action, but rather is often merely a confirmation of what has already been made known by the retail partner that fined the vendor the late delivery or shorted pallet. Thus, the lost efficiency of the analysts and the fees assessed by the retailers become additional costs in too many cases, and analysis of this data is simply not conducted. However, those vendors that are able to aggressively track this data and address issues that may arise in a timely manner can avoid fees and improve their relationships with their retailers. Unfortunately, upper management often struggles to see beyond the concrete costs figures and consider these less concrete but no less important opportunity for increased revenues or avoided fees.

Improving Responsiveness and Managing Demand Volatility and Variability

The delayed turnaround inherent in the difficulties discussed above relate directly to improving the responsiveness of the supply chain. That is, supply chain utilization must address two areas of responsiveness:

- Responding to existing issues

- Responding to potential issues

Existing issues, as already discussed, are difficult to ID due to the disparate sources of data and the corresponding amount of time it takes to collate the information and determine what issues actually exist, since addressing existing issues is time-sensitive.

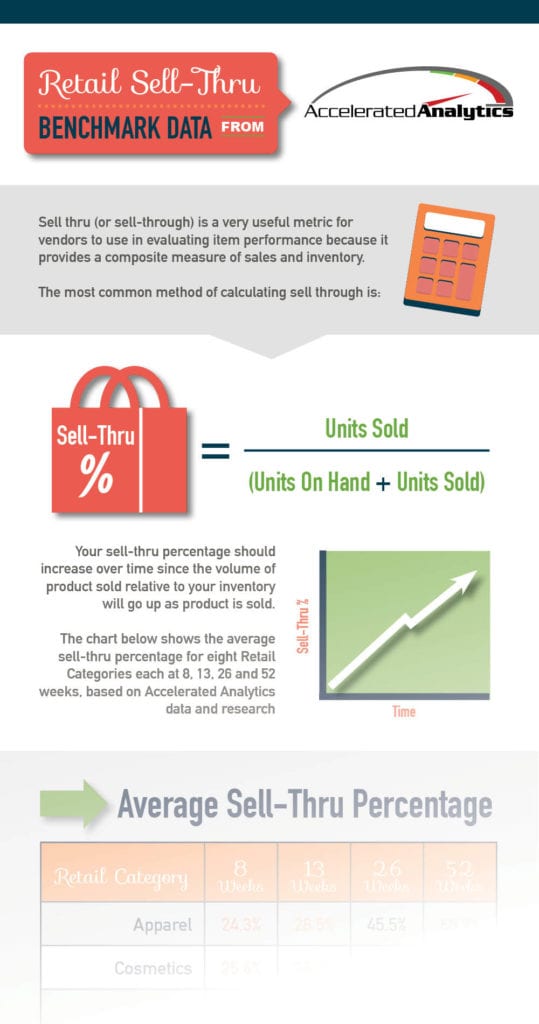

Potential issues are no less difficult, since these are often identified by considering all the aforementioned data sources and then including additional data sources such as POS data (from which forecasts are derived). Mike Griswold, VP Retail for AMR Research, says, supply chain optimization “involves better forecasting methods and moving away from looking at warehouse shipments and toward POS and online sales data.” He goes on: many vendors fail to utilize POS data effectively for addressing supply chain issues because “it’s easier to get your arms around warehouse shipments because you’re dealing with weekly or twice-weekly sources of data. When you get to POS, you’re getting down to day-level granularity for items and stores, and creating a forecast for three or four weeks out requires a fair amount of processing power.” Of course, Griswold qualifies his position—forecasting based on POS and other data sources isn’t the final step. “Retail is not designed to be an inventory holding area,” he says. “You may [get] an order for 1,000 televisions to be deployed across 100 stores, but not every store can handle 10 of each item.”

Thus, forecasts must be based on actual POS historical sales, current trends, other considered supply chain factors, and tempered by the limitations of the stores for which the forecasts are generated. Retailers provide a shelf-space and assortment designation (called plan-o-grams, modulars, sets, etc.) for most vendors which allows vendors to consider these factors when filling orders, and combined with their own warehouse quantities and capacity, now a very comprehensive and useful picture emerges, from which one may then deduce those potential issues and act to address them, instead of reacting after they become a time-sensitive emergency.

How Accelerated Analytics® Can Help You Optimize Your Supply Chain

Unfortunately, University of Pennsylvania professor of Operations and Information Management Marshall Fisher says the industry trend for vendors faced with the decision to have too little inventory and lose sales or have too much and be forced to liquidate leans toward the former. “Most companies are just moving along with less inventory. They are downsizing to meet less demand and accepting higher stockouts. The risk of a lost sale is smaller than having lots of unsold inventory.”

But what if you had an integrated database solution that tied all of the disparate sources of data together into a single source of truth, from which actionable decisions could be made on timely, comprehensive data? The Rainmaker Group™, creators of Accelerated Analytics®, was first a business intelligence (BI) company and its expertise in BI solutions can be leveraged to create such an integrated database behind the Accelerated Analytics® interface, creating a powerful yet user-friendly tool that business users need and which management can understand.

Advantages offered by Accelerated Analytics®:

- Integrated database to tie together all your data sources (P.O. files, Shipping documents, POS data, Plan-o-gram files, and more!) in a single location from which may be derived a single source of truth.

- User-friendly reporting solution which provides rapid access to any of the data in the system and reduces the overhead normally associated with the collation and calculation of data

- Exceptions reporting to identify shipping delays, stockouts, etc. automatically as often as required.

- Proven forecasting methodology to generate proactive forecasts based on actual sales and inventory information