With consumer confidence currently at a 17-year high (as reported in our Retail Industry Briefing Book) it makes sense that holiday retail sales in the U.S. rose at their best pace since 2011, according to Mastercard SpendingPulse, which tracks both online and in-store spending. Excluding automobiles, sales rose 4.9% from Nov. 1 through Christmas Eve, compared with a 3.7% gain in the same period last year.

“It started with a bang in the week leading up to Black Friday,” said Sarah Quinlan, a senior vice president of marketing insights at Mastercard. She added that retailers benefited this year from Christmas Day falling on a Monday, giving shoppers a full weekend to scoop up last-minute purchases. Dec. 23 ranked next to Black Friday in terms of spending, according to Mastercard.

“Overall, this year was a big win for retail,” Ms. Quinlan said.

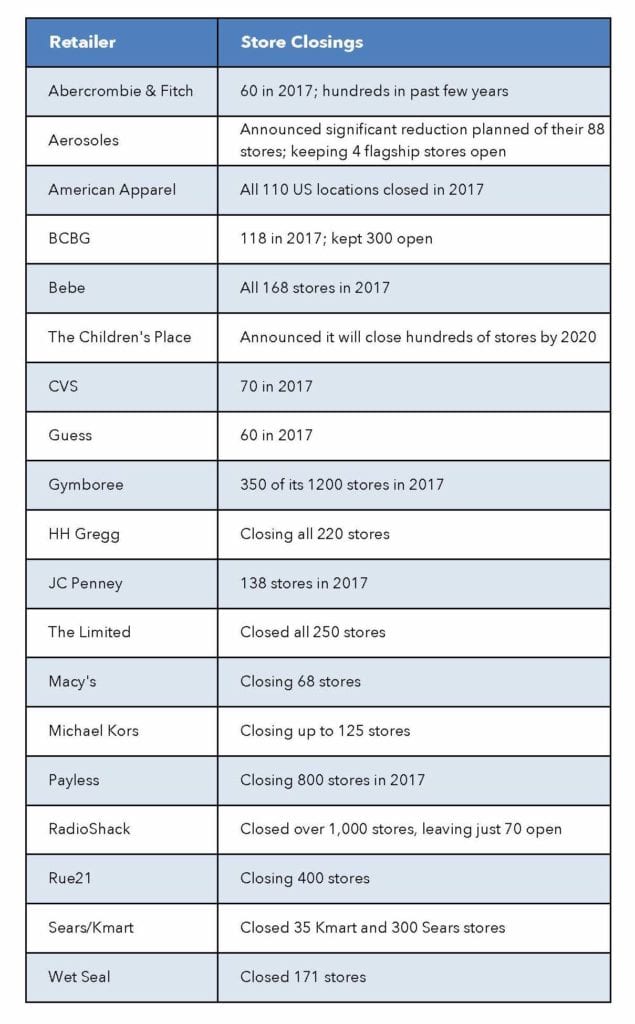

Retailers are breathing a sigh of relief. From department-store giants like Macy’s to mall favorites like The Gap, brick and mortar retail struggled through a difficult year of store closures.

In past years spending was driven by high-income shoppers, but this year there is a lot more spending from the lower- and middle-income groups due to rising wages and low unemployment.

Source: Wall Street Journal