Price Elasticity is used by economists to understand how supply or demand changes work in the real economy when price changes are made to a product or service. When it comes to setting the prices for your products and services, it can be a difficult decision to face. At some point, every company or business must decide on pricing. For the business owners, economists, data analysis, executives, even a marketers, this is no easy task.

Your pricing determines everything, especially the bottom line of your company. You have to understand pricing and what elements decide it. Economists refer to this by price elasticity. If you’ve never heard of it, don’t worry, we’re going to cover it from the start.

What Is Price Elasticity?

The majority of customers in several industries are sensitive to the price of a product or service. This assumption means that more people will buy a product or service if it’s cheaper and people will buy less if it’s more expensive.

It goes deeper than just that, price elasticity can show us how responsive customer demand is for a product based on its price point. You have to understand how sensitive your customers are too pricing, the price elasticity formula can give you that answer.

You’ll find that some products have an immediate response to price changes, these are usually products that are non-essentials. Most of these products have many substitutes customers could pursue. A good example to use is eggs. If the price of eggs dramatically increases and demand falls, people would find a way to substitute eggs.

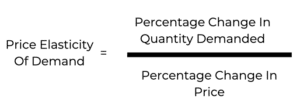

How Is Price Elasticity Calculated?

The price elasticity formula is simple.To better help you understand, let’s look at an example.

Company XYZ has decided to raise their price on one of their name brand shirts from $80 to $100. The price increase is $100 – $80 is $20 or 20 percent. Now, due to the price increase, sales have dropped from 500 shirts being sold to 400 shirts sold. The percentage decrease in demand for the shirt is -20 percent. If we use these numbers in the formula, we get a price elasticity of demand.

Now, it’s important to note that we ignore the negative and the absolute value of the number is used to interpret the price elasticity metric. This is because the magnitude of distance from zero is what matters in the equation, not the positive or negative attached.

The higher your absolute value is, the more sensitive your customers are going to be to price changes. Pretty cool, right?

The 5 Zones Of Price Elasticity

There’s thought to be 5 zones as it pertains to price elasticity and your company falls into one of these 5 zones. It’s important to understand which zone that is so you know how your customers will react if you choose to hike your prices.

- Perfectly Elastic – In this zone, there’s very small changes in price results in a very large change in the quantity demanded. Products that fall in this category are mostly “pure commodities.” In that case, there’s no attachment to the brand, nothing meaningful about the service, nor no product differentiation. Think water, gas, electric, etc.

- Relatively Elastic – This zone is where small changes in your price cause large changes in quantity demanded (the result of the formula is greater than 1). Eggs, as discussed above, is an example of a product that is relatively elastic.

- Unit Elastic – For this zone, this is where any change in price is matched by an equal change in quantity (where the number is equal to 1).

- Relatively Inelastic – This is the zone where large changes in your price cause small changes in demand (the number is less than 1). Gasoline is a great example to use here because most people need it in their daily life, so even when prices go up, demand doesn’t change a lot.

- Perfectly Inelastic – In this zone, this is where the quantity demanded does not change when the price changes. Products in this category are things consumers absolutely need and there are no other options from which to obtain them.

How Do Companies Use It?

There’s many ways price elasticity can be used to help a business. Every company has the task of creating unique services and products. Every company has the task of creating value for their customers. We can use price elasticity to measure how we’re doing in that area.

Our goal is to move product from relatively elastic to relatively inelastic. How can we achieve that? We use branding and marketing to build desire with our target audience. We want our customers to have desire for our products or services. When a company has built that desire, customers are willing to buy regardless of price.

Remember, price elasticity is only one metric that you can calculate when you raise the price of a product or service. Companies usually don’t use this in “practice.” Rather, they send out surveys, questionnaires or operate small focus group experiments in select industries. This allows them to get a sense of what may happen if a price change occurs.

While price elasticity is certainly something you want to understand and leverage, price sensitivity is more of a qualitative concept. Even so, price elasticity and price sensitivity are closely related.

Common Mistakes With Price Elasticity

While the price elasticity formula is not complicated, most companies assume they know how the marketplace will react with price changes based on their experiences alone. The majority of companies don’t do extensive testing on price changes. The companies that do, they usually only have a small sample size to test from.

It’s impossible to know how the market will react at every price point possible. Sure, you can get a good sense by doing your research, doing your studies, surveys and experiments. However, there can be a lot of inaccuracies in these test. Customers may say one thing but do another, it’s always difficult to have completely accurate data.

The best thing a company can do is A/B testing. You put Product A in the market, give it 2 price points and see what the demand is for both. Your feedback data will only get you so far. The only way to really know what a price change will do in the market is through A/B testing those 2 price points against one another.

Lastly, you want to understand consumer behavior to learn why your customers are reacting the way they are. Why did consumers react like this when we lowered the price? What did consumers say when we raised the price? If you can understand this now, it’s going to prepare you for what you do in the future. It’s going to help your marketing be more on point, you’re going to know where to focus your effort. As a company executive, you want to know these things so you can lead the marketing efforts in the right manner.

Most importantly, you want your products and services to stand out in the market versus that of your competition. You want your company to stay relevant, you want your company to clearly be different versus your competition. Understanding price elasticity of demand for your product doesn’t explain how you should manage it.

You want to understand your current price elasticity and those factors that make it either elastic or inelastic. These factors are always changing, it’s your job to know them and know them better than anyone else.

Elastic Glossary Terms

- Elastic Demand – When the elasticity of demand is greater than (1), this indicates a high responsiveness of quantity demanded or supplied when price changes are made.

- Elastic Supply – When the elasticity of either supply is greater than (1), indicating a high responsiveness of quantity demanded or supplied to changes in price elasticity an economics concept that measures responsiveness of one variable to changes in another variable.

- Inelastic Demand – When the elasticity of demand is less than (1), this indicates that a 1 percent increase in price paid by the consumer will lead to less than a 1 percent change in purchases (and vice versa); this indicates a low responsiveness by consumers to price changes.

- Inelastic Supply – When the elasticity of supply is less than one, indicating that a 1 percent increase in price paid to the firm will result in a less than 1 percent increase in production by the firm; this indicates a low responsiveness of the firm to price increases (and vice versa if prices drop).

- Price Elasticity – The relationship between the percent change in price resulting in a corresponding percentage change in the quantity demanded or supplied.

- Price Elasticity Of Demand – The percentage change in the quantity demanded of a good or service divided the percentage change in price

- Price Elasticity Of Supply – The percentage change in the quantity supplied divided by the percentage change in price.

- Unitary Elasticity – When the calculated elasticity is equal to one indicating that a change in the price of the good or service results in a proportional change in the quantity demanded or supplied.