Last week, I had the opportunity to work with two different customers analyzing their sales at The Home Depot. One sells products in the paint department and the other sells into the building materials department. The analysis goal for both customer projects was to deconstruct their YTD sales and identify the factors contributing to higher than expected comp sales increases. Both customer’s sales for a set of key SKU’s were up about 2.5% YoY and the question they wanted answered was, “What is driving the higher sales, and will it continue?”

As we deconstructed their respective sales into its component parts of distribution, price, and rate of sale, we uncovered interesting data regarding average retail selling price. The first customer’s average retail price was pretty consistent across Home Depot stores at the expected $22.95 retail price. There were some fluctuations, but the data was pretty clustered, as expected.

As we deconstructed their respective sales into its component parts of distribution, price, and rate of sale, we uncovered interesting data regarding average retail selling price. The first customer’s average retail price was pretty consistent across Home Depot stores at the expected $22.95 retail price. There were some fluctuations, but the data was pretty clustered, as expected.

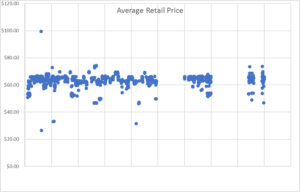

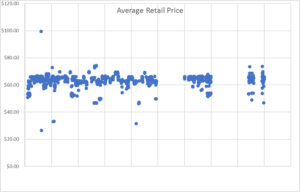

In contrast, the second customer’s average retail price was very inconsistent. Customer #2 believed that The Home Depot was pricing their core SKU at $59.95 or $65.95, depending on the market. However, as you can see in Figure 2, the pricing was very inconsistent across stores. In fact, we identified stores in the same Home Depot market with a selling price variance of $28.35 per unit.

While there can be good reasons to price a product differently by market due to shipping costs or competitive pressures, it seems irregular to have different prices within the same market. Take a look at the average retail price of your products. It’s an important exercise that can yield some interesting insights. It presents an opportunity to have a conversation with your merchant about pricing strategies. And, It also provides an opportunity to identify markets with similar demographic profiles, but different selling prices, thus providing insight into what price point drives the highest sales.

Does your average selling price match your expectations? The answer may not be as simple as you think and could reveal some interesting insights.